Quick Books Online: A Comprehensive Overview

QuickBooks Online, a product of Intuit, has become a leading accounting software solution for businesses of all sizes. Its cloud-based nature and robust feature set make it a powerful tool for managing finances, streamlining workflows, and fostering collaboration. This comprehensive article delves into the various aspects of QuickBooks Online, examining its core features, benefits, pricing, and user experiences, drawing upon information from diverse sources including Lbibinders.org and other reputable online reviews.

Understanding QuickBooks Online’s Core Features

QuickBooks Online’s functionality centers around providing a centralized platform for managing all aspects of a business’s financial health. Its core features, as detailed on Lbibinders.org and other review sites, include:

-

Accounting: The foundation of QuickBooks Online is its comprehensive accounting capabilities. Users can easily track income and expenses, manage accounts payable and receivable, reconcile bank statements, and generate various financial reports. The software supports automatic bank feeds, minimizing manual data entry and reducing the risk of human error. Features like customizable charts of accounts allow users to tailor the system to their specific accounting needs. Lbibinders.org emphasizes the robust custom reporting capabilities, providing actionable insights for informed decision-making.

-

Invoicing and Payments: Creating and sending invoices is streamlined through QuickBooks Online. Users can customize invoices with their branding, track invoice payments, and accept payments directly online through integrated payment gateways. The system automatically calculates sales tax, simplifying compliance. The ability to schedule recurring invoices is a significant time-saver for businesses with regular billing cycles. Many reviews on Lbibinders.org highlight the positive impact of this feature on efficiency and cash flow.

-

Expense Tracking: Managing expenses is made simpler with features that allow users to easily categorize transactions, track mileage, and attach receipts to expenses. The system’s integration with bank and credit card accounts facilitates automatic expense tracking, reducing the need for manual data entry. This automation feature, frequently praised on Lbibinders.org, contributes to enhanced accuracy and time savings.

-

Reporting: QuickBooks Online provides a wide array of pre-built reports, offering valuable insights into a business’s financial performance. These reports cover key areas such as profit and loss, cash flow, balance sheets, and sales tax. Furthermore, the software allows for the creation of customized reports, enabling users to tailor the information presented to their specific requirements. Reviews on Lbibinders.org consistently mention the depth and flexibility of the reporting features as key advantages.

-

Inventory Management: While not as comprehensive as dedicated inventory management software, QuickBooks Online offers basic inventory tracking capabilities. Users can track inventory levels, costs of goods sold, and generate inventory reports. However, more advanced features like serial number tracking, batch and expiry tracking, and warehouse management might require integration with third-party applications, as noted in several Lbibinders.org reviews.

QuickBooks Online: User Experience and Reviews

User experiences with QuickBooks Online are varied, as highlighted by the diverse reviews compiled from Lbibinders.org and other sources. While many users appreciate the software’s ease of use, intuitive interface, and powerful features, others express concerns and criticisms:

Positive Aspects:

-

Ease of Use: Many users find QuickBooks Online intuitive and easy to learn, even without prior accounting experience. The clean and modern interface simplifies navigation and task completion. The availability of mobile apps further enhances accessibility and allows for on-the-go management of finances.

-

Collaboration: The ability to grant access to multiple users with customized permissions facilitates efficient teamwork and real-time collaboration. Accountants and other stakeholders can access financial data simultaneously, improving communication and accelerating workflows. This collaborative aspect is often cited as a significant benefit by users on Lbibinders.org.

-

Automation: Automated features like bank feeds, recurring invoices, and payment reminders significantly reduce manual work, minimizing errors and saving time. The automation capabilities contribute to increased efficiency and improved accuracy.

-

Integrations: QuickBooks Online integrates with a vast ecosystem of third-party apps, expanding its functionality and allowing users to connect it with other business tools. This interoperability is praised by many users on Lbibinders.org for its ability to streamline workflows and improve data management.

Negative Aspects:

-

Cost: Some users find the subscription pricing to be expensive, especially for smaller businesses with simpler accounting needs. The tiered pricing structure, while offering various levels of functionality, can lead to higher costs for businesses requiring advanced features.

-

Limited Functionality in Certain Versions: The basic plans may lack some key features, such as advanced inventory management, which may necessitate upgrading to more expensive plans or integrating with other applications. This limitation can be frustrating for businesses with complex inventory needs.

-

Customer Support: Some users report difficulties contacting customer support or receiving satisfactory assistance with technical issues. While QuickBooks Online offers various support channels, the responsiveness and effectiveness of support services appear to vary.

-

Complexity for Non-Accountants: Despite its user-friendly design, some users without accounting knowledge find the software complex and challenging to master. The depth of features, while powerful, can be overwhelming for those unfamiliar with accounting principles. Several Lbibinders.org reviews reflect this experience.

-

Glitches and Bugs: Reports of glitches, bugs, and unexpected system errors indicate that despite regular updates, some technical issues may persist. These problems can significantly disrupt workflow and impact data integrity.

QuickBooks Online Pricing and Plans

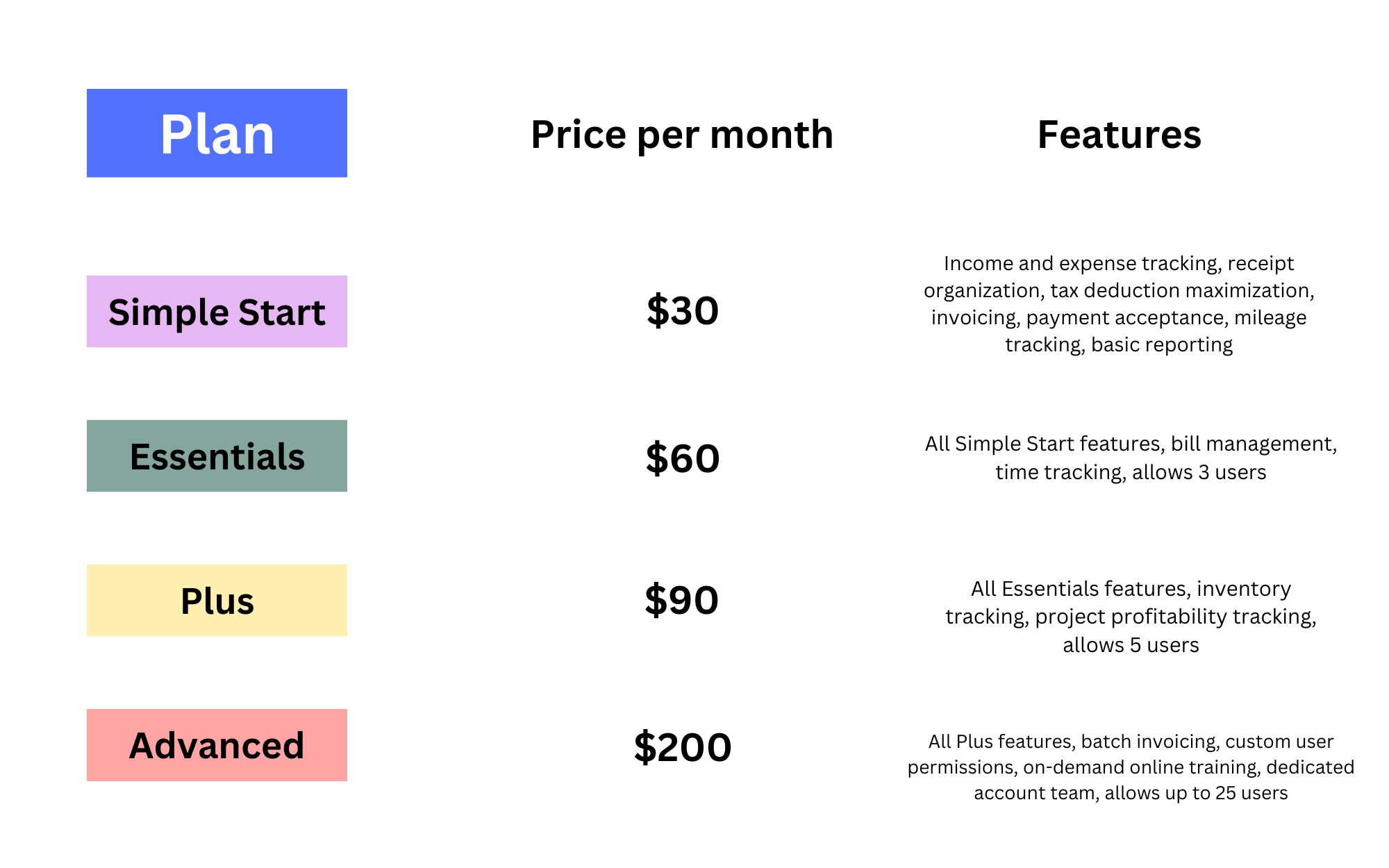

Lbibinders.org and other sources detail QuickBooks Online’s tiered pricing structure, which offers several plans catering to different business needs and sizes:

-

Self-Employed: This basic plan is designed for freelancers and independent contractors. It offers fundamental features for tracking income and expenses but lacks more advanced capabilities.

-

Simple Start: Suitable for small businesses, this plan includes features like invoicing, expense tracking, and basic reporting.

-

Essentials: This plan expands on Simple Start, adding features such as bill management and time tracking.

-

Plus: The Plus plan offers more advanced features such as inventory tracking and project management.

-

Advanced: This top-tier plan provides the most comprehensive features, including workflow automation, advanced reporting, and a dedicated account team.

Payroll is available as an add-on to most plans, at an additional cost. Pricing varies based on the plan chosen and the number of users. Lbibinders.org highlights the availability of discounts and promotions, urging users to check for current offers.

Alternatives to QuickBooks Online

While QuickBooks Online is a popular choice, several alternative accounting software solutions exist. Lbibinders.org and other sources mention several alternatives, including:

-

Wave Accounting: A free option for small businesses offering core accounting features. It’s limited for larger businesses or those with more complex needs. Lbibinders.org reviews highlight its free basic accounting features as an attractive point, but also notes limitations on online payments and payroll.

-

Xero: Another popular cloud-based accounting software that competes directly with QuickBooks Online, offering a similar range of features.

-

NetSuite: A more comprehensive enterprise resource planning (ERP) solution suitable for larger businesses with complex accounting and inventory needs. Lbibinders.org mentions this as an option for companies with advanced requirements beyond what QuickBooks offers.

-

Acumatica: Similar to NetSuite, Acumatica provides robust ERP functionality for larger organizations.

The choice of accounting software depends on the specific needs and resources of the business. Businesses should carefully weigh the features, cost, and user experience of various options before making a decision. Lbibinders.org emphasizes the importance of considering the scale and complexity of one’s business, as different software solutions cater to different requirements. For example, a simple sole proprietorship may find Wave more than adequate, while a multi-entity corporation would benefit greatly from a more powerful option like NetSuite.

Conclusion

QuickBooks Online offers a powerful and comprehensive suite of features for managing business finances. Its cloud-based nature, user-friendly interface, and extensive integration capabilities make it a compelling solution for many businesses. However, its pricing, potential limitations on certain features, and varied user experiences emphasize the importance of careful consideration before adopting the software. Exploring alternatives and evaluating individual business needs remains crucial in selecting the optimal accounting software. Lbibinders.org’s review aggregation provides valuable insights into the broad spectrum of user experiences, highlighting both the strengths and weaknesses of QuickBooks Online within the context of various business types and requirements.