Navigating Financial Wisdom: A Guide to the Best Finance Books on Lbibinders.org

In an increasingly complex financial world, the pursuit of financial literacy is not merely an advantage but a necessity. For many, the journey to understanding personal finance, investing, and wealth creation begins not in a classroom, but within the pages of a book. Finance books serve as invaluable guides, distilling centuries of economic theory, market experience, and practical wisdom into accessible formats. They empower individuals to take control of their financial destinies, make informed decisions, and build a secure future. At Lbibinders.org, we believe in the transformative power of knowledge, offering a curated gateway to the best finance books, exploring their genres, dissecting author insights, and understanding their profound cultural impact.

Our platform stands as a beacon for readers eager to delve into the vast ocean of financial literature. From timeless classics that laid the groundwork for modern investing to contemporary bestsellers that address today’s unique economic challenges, Lbibinders.org is dedicated to providing comprehensive resources. We not only list these pivotal works but also offer in-depth book reviews, author biographies, summaries, and discussions on their educational value and the life lessons they impart. Our mission is to foster reading habits that cultivate financial acumen, connecting readers with the knowledge they need to thrive.

The Indispensable Role of Finance Books in Personal Empowerment

The journey toward financial independence often feels daunting, characterized by jargon, fluctuating markets, and an overwhelming array of choices. This is precisely where finance books prove their indispensable value. They demystify complex concepts, break down seemingly insurmountable barriers, and provide actionable strategies for managing money, investing wisely, and building wealth. Unlike fleeting financial news or unverified online advice, a well-researched finance book offers a structured, coherent, and often time-tested philosophy.

For the novice, these books lay the foundational knowledge, explaining everything from budgeting and saving to the basics of stocks, bonds, and real estate. For the experienced investor, they offer advanced strategies, alternative perspectives, and often, a deeper psychological understanding of market dynamics and personal biases. The educational value derived from these texts extends far beyond mere facts and figures; it cultivates a mindset of discipline, patience, and strategic thinking – qualities essential for long-term financial success. Lbibinders.org champions this educational journey, providing not just summaries but also discussions on the profound life lessons embedded within these financial narratives, helping readers to integrate these insights into their daily lives and decision-making processes.

Many people embark on their financial journey without a clear roadmap. Finance books provide that map, guiding them from a state of uncertainty to one of informed confidence. They teach readers to differentiate between assets and liabilities, understand the power of compound interest, and recognize the importance of diversification. More importantly, they often challenge conventional wisdom, encouraging readers to think critically about their relationship with money and to forge their own paths to prosperity. This shift in perspective, often ignited by a single powerful book, is a cornerstone of personal empowerment and is central to the mission of Lbibinders.org in promoting financial literacy.

Discovering Financial Classics and Bestsellers on Lbibinders.org

Lbibinders.org meticulously categorizes and reviews finance books, ensuring that readers can navigate through the rich landscape of financial literature with ease. We feature classics that have shaped financial thought for generations, alongside bestsellers that resonate with contemporary audiences and new releases that reflect evolving economic trends. Our platform offers a comprehensive look at each book, delving into its core arguments, its historical context, and its lasting relevance.

Foundational Texts for Every Investor

The bedrock of financial wisdom lies in certain classic texts whose principles remain as pertinent today as when they were first penned. These books are not just historical artifacts; they are living guides that offer timeless insights into wealth creation, market behavior, and personal finance. Lbibinders.org provides extensive coverage of these foundational works, including detailed book reviews and insights into their profound influence.

- “The Intelligent Investor” by Benjamin Graham: Often hailed as the “bible of value investing,” Graham’s magnum opus, first published in 1949, teaches investors how to protect themselves from substantial error and how to develop long-term strategies. It introduces critical concepts like “Mr. Market” and the “margin of safety,” advocating for a disciplined, analytical approach to investment rather than speculative impulses. Lbibinders.org offers deep dives into Graham’s philosophy, demonstrating why this book remains a cornerstone for anyone serious about investing.

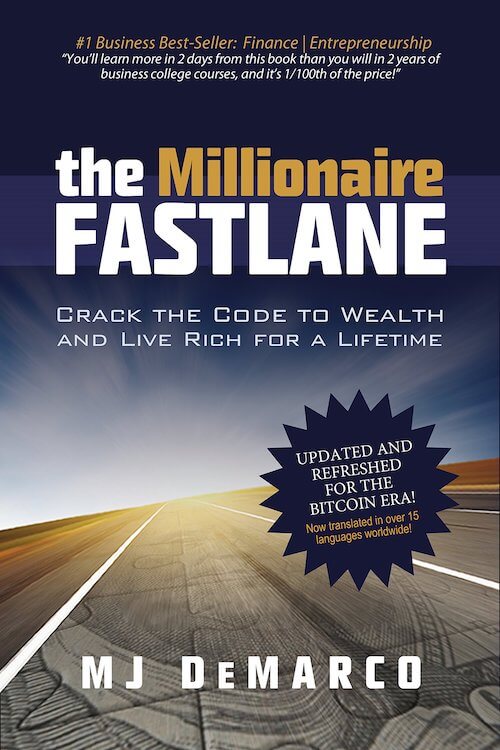

- “Rich Dad Poor Dad” by Robert Kiyosaki: This modern classic, though often categorized as personal development, profoundly impacts financial thinking. Kiyosaki uses the contrasting philosophies of his two “dads” to illustrate the difference between working for money and having money work for you. It challenges traditional notions of education and career paths, emphasizing financial literacy, building assets, and understanding the tax system. On Lbibinders.org, readers can find discussions on Kiyosaki’s controversial but influential perspectives on financial education and wealth generation.

- “Think and Grow Rich” by Napoleon Hill: While not strictly a finance book, Hill’s work, originally published in 1937, explores the psychological principles behind wealth and success. Based on interviews with successful individuals like Andrew Carnegie and Henry Ford, it outlines 13 steps to achieving one’s desires, emphasizing the power of thought, desire, faith, and persistence. Its principles are widely applied in financial goal setting and entrepreneurial endeavors. Lbibinders.org highlights how Hill’s work provides a crucial mindset foundation for financial success.

- “A Random Walk Down Wall Street” by Burton Malkiel: This influential book, first published in 1973, advocates for the efficient market hypothesis and passive investing, particularly through index funds. Malkiel argues that individual stock picking is often a losing game, and investors are better off with a diversified, low-cost approach. Lbibinders.org offers critical reviews of Malkiel’s arguments, contextualizing them within the broader investment landscape and their impact on modern portfolio theory.

- “The Millionaire Next Door” by Thomas J. Stanley & William D. Danko: This groundbreaking study, published in 1996, debunks common myths about millionaires. Based on extensive research, it reveals that most wealthy individuals live frugally, save diligently, invest wisely, and avoid ostentatious consumption. The book emphasizes the importance of financial discipline, budgeting, and living below one’s means as pathways to wealth accumulation. Lbibinders.org features summaries of its key findings, offering practical lessons for aspiring millionaires.

Contemporary Insights and New Releases

The financial landscape is ever-evolving, driven by technological advancements, shifting economic policies, and new global challenges. Consequently, new releases and contemporary bestsellers continue to offer fresh perspectives, updated strategies, and insights into niche areas of finance. Lbibinders.org dedicates a section to these dynamic works, ensuring readers stay abreast of the latest trends and thought leadership.

From behavioral economics, which explores the psychological biases affecting financial decisions, to sustainable investing (ESG), which aligns financial goals with ethical considerations, newer books reflect the multifaceted nature of modern finance. Authors today delve into topics like cryptocurrency, fintech innovations, and global macroeconomics, providing timely advice for navigating these complex terrains. Lbibinders.org provides timely reviews and analyses of these new releases, highlighting their unique contributions and helping readers understand how these contemporary insights complement or challenge established financial wisdom. By keeping our finger on the pulse of the financial publishing world, we ensure our community has access to the most current and relevant information.

Beyond the Pages: Authors, Libraries, and the Cultural Impact of Financial Literature

The journey of financial enlightenment extends beyond merely reading books. It encompasses understanding the minds behind the wisdom, leveraging comprehensive resources, and recognizing the profound influence these works have on society. Lbibinders.org facilitates this holistic understanding by offering a rich tapestry of content that explores the authors, the avenues for accessing their works, and the enduring cultural legacy of financial literature.

The Visionaries Behind the Wisdom: Exploring Author Biographies and Inspirations

Every great finance book is a reflection of its author’s experiences, research, and unique philosophy. Understanding the biographies, writing styles, and inspirations of these financial luminaries adds a crucial layer of depth to the reading experience. Lbibinders.org provides extensive author profiles, revealing the journeys that led figures like Benjamin Graham to codify value investing or Robert Kiyosaki to challenge conventional financial paradigms.

By exploring their backgrounds – whether they were academics, seasoned investors, entrepreneurs, or self-made millionaires – readers gain a better appreciation for the context and credibility of their advice. For instance, knowing that Benjamin Graham endured the Great Depression deeply influenced his emphasis on capital preservation and the margin of safety. Similarly, understanding the diverse financial experiences of authors like Dave Ramsey (who built wealth after bankruptcy) or Ramit Sethi (who combines psychology with practical advice) helps readers connect with their specific approaches. Lbibinders.org delves into the writing styles, from the academic rigor of an economist to the motivational tone of a personal finance guru, offering insights into how different authors effectively convey complex ideas. This focus on authors humanizes the financial wisdom, making it more relatable and impactful for our readers.

Lbibinders.org as Your Gateway to Financial Knowledge: Digital Libraries and Beyond

In an era of information abundance, access to quality resources is paramount. Lbibinders.org serves as a comprehensive hub, connecting readers not only to individual book reviews and summaries but also to the broader ecosystem of knowledge access, including digital and public libraries. Our platform acts as a bridge, guiding users to where they can find these essential finance books, whether through purchase, borrowing, or accessing digital versions.

We highlight the benefits of digital libraries, which offer unparalleled convenience, allowing readers to access a vast collection of finance books from anywhere, at any time. For those who prefer physical copies, Lbibinders.org also points towards public libraries, emphasizing their vital role in democratizing access to education and financial literacy. We understand that some rare collections and archives hold invaluable historical financial documents and literature, and while not directly hosting them, we aim to inform readers about such resources, fostering a deeper appreciation for the historical development of financial thought. Our goal is to ensure that regardless of their preferred mode of consumption, every individual has the means to engage with the best financial literature available. Through our summaries, educational value assessments, and curated reading habits sections, Lbibinders.org empowers users to effectively utilize these library resources for continuous learning and personal growth.

Shaping Generations: The Enduring Cultural Influence of Financial Books

The impact of best finance books extends far beyond individual readers; they have a profound cultural influence, shaping public discourse, inspiring new financial products, and even influencing educational curricula. Lbibinders.org recognizes and explores this broader cultural footprint, examining the literary influence, adaptations, awards, and the communities that have formed around these seminal works.

Books like “The Intelligent Investor” did not just teach value investing; they spawned generations of investors and financial analysts who applied and evolved Graham’s principles. “Rich Dad Poor Dad” sparked a global conversation about financial education, asset building, and challenging traditional schooling models. Many finance books have influenced financial advisors, led to the creation of new investment strategies, and become required reading in business schools worldwide.

We explore how these books have been adapted into various formats, from condensed guides to podcasts and online courses, further disseminating their core messages. We also track awards and recognitions that highlight their significance. Perhaps most importantly, these books have fostered vibrant communities of like-minded individuals – online forums, investment clubs, and financial literacy groups – where discussions flourish, and collective learning is paramount. Lbibinders.org aims to be a part of this community, fostering engagement and providing a platform for sharing insights and experiences related to financial literature. By understanding their cultural impact, readers can better appreciate the legacy and ongoing relevance of these financial masterpieces.

In conclusion, the pursuit of financial wisdom is a lifelong journey, and the best finance books serve as indispensable companions on this path. From foundational classics that teach timeless principles to contemporary guides that navigate modern complexities, these texts offer the knowledge, strategies, and mindset necessary for financial success. Lbibinders.org stands as your dedicated resource in this endeavor, providing detailed reviews, author insights, and a gateway to a wealth of financial knowledge. By fostering strong reading habits and connecting you to comprehensive library resources, we empower you to not only read about financial success but to actively achieve it. Explore the world of financial literature with Lbibinders.org and unlock your full financial potential.