Dave Ramsey Books: A Comprehensive Guide to His Financial Wisdom

Dave Ramsey, a prominent American financial expert and radio host, has penned numerous best-selling books that offer practical advice and a proven plan for achieving financial peace. His work resonates with millions, providing a clear, straightforward approach to managing money and building wealth. This article explores the breadth of Dave Ramsey’s literary contributions, examining his books, writing style, impact, and enduring legacy. We will delve into various aspects of his work, drawing from information available on Lbibinders.org and other reputable sources.

Dave Ramsey’s Literary Works: A Genre Exploration

Dave Ramsey’s books largely fall under the genre of personal finance, though elements of self-help, Christian principles, and business advice are often interwoven. His writing style is characterized by its directness, practicality, and motivational tone. He avoids complex financial jargon, opting for clear, concise language easily understood by a broad audience. This accessibility is a hallmark of his work, making it appealing to both seasoned investors and those just starting their financial journeys. His use of anecdotes and personal experiences adds a relatable human element to his often tough-love approach to financial responsibility.

Many of his books follow a similar structure: outlining core financial principles, debunking common myths, and providing actionable steps towards achieving financial goals. This consistency fosters a sense of familiarity and trust among his readers. The books also often include worksheets, budgeting forms, and supplementary resources to help readers actively engage with the material and implement his methods.

Here’s a closer look at some of Dave Ramsey’s most popular and influential works:

Bestselling Books and Their Core Messages:

-

Financial Peace Revisited (2002, original 1992): This foundational work lays the groundwork for Ramsey’s financial philosophy. It emphasizes budgeting, eliminating debt, and building wealth through practical steps. The book’s “KISS” (Keep It Simple, Stupid) approach to investing simplifies complex financial strategies, making them accessible to the average person. Financial Peace Revisited also highlights the importance of contentment and its role in financial decision-making.

-

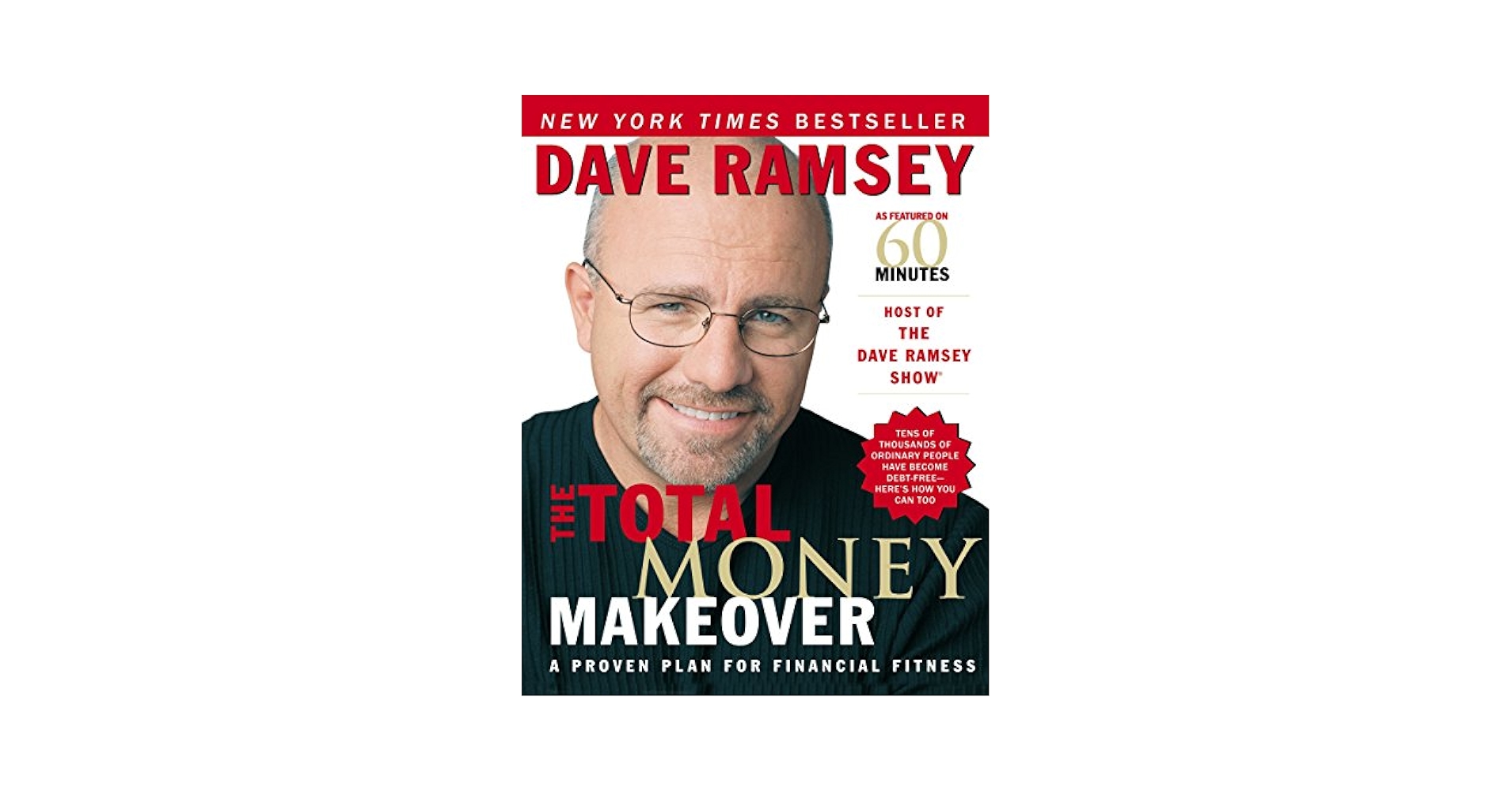

The Total Money Makeover (2003, revised 2013): A cornerstone of Ramsey’s teachings, this book presents a seven-step plan (the Baby Steps) to conquer debt and build wealth. It utilizes the “debt snowball” method, a highly effective strategy for motivating individuals to tackle debt systematically. The book challenges readers to confront their spending habits and adopt a more disciplined approach to financial management. The revised edition further expands on issues like marriage conflict and college debt.

-

The Total Money Makeover Workbook (2004, revised 2018): A companion to The Total Money Makeover, this workbook complements the book’s principles with worksheets, exercises, and further motivational content, facilitating the practical application of Ramsey’s financial strategies.

-

Dave Ramsey’s Complete Guide to Money (2011): This comprehensive guide encapsulates Ramsey’s core principles, expanding on topics such as budgeting, debt elimination, investing, retirement planning, insurance, and homeownership. It provides a holistic approach to financial management, guiding readers through the entire process of achieving financial wellness.

-

Baby Steps Millionaires (2022): This book dives deep into Baby Step 4 of Ramsey’s Total Money Makeover, focusing on building wealth through strategic investing. It features inspiring stories and provides clear, practical guidance for anyone aspiring to build a significant net worth, demonstrating that building wealth is achievable for ordinary individuals.

-

EntreLeadership (2011): While not strictly a personal finance book, EntreLeadership leverages Ramsey’s financial expertise to provide business leadership advice. It emphasizes the importance of strong leadership, team unity, and sound financial management in achieving entrepreneurial success.

Other Notable Works:

Ramsey’s extensive catalog also includes books specifically targeted towards children and teenagers, equipping young people with the foundational financial knowledge they need to make sound financial decisions from an early age. These titles, often presented in a storybook format, engage children in learning about concepts such as saving, spending, working, and giving. He also delves into spiritual and ethical aspects of wealth management, exploring the intersection of faith and finance, guiding readers on how to live a generous and fulfilling life.

Dave Ramsey’s Writing Style and Influences

Ramsey’s writing is notable for its accessibility and motivational tone. He uses relatable stories, straightforward language, and a conversational style, making complex financial concepts easily understandable for the average reader. He often incorporates elements of humor and his signature “tough love” approach, encouraging readers to take personal responsibility for their financial situations and actively work towards their goals.

The key influences on Ramsey’s work include his own personal experiences with financial success and bankruptcy. These experiences are frequently cited to add authenticity and credibility to his advice. He also draws significantly from his Christian faith, incorporating biblical principles of stewardship and generosity throughout his work, emphasizing responsible financial management as a means of achieving both material and spiritual well-being.

The Educational Value and Life Lessons in Dave Ramsey’s Books

Beyond providing practical financial guidance, Ramsey’s books offer valuable life lessons. His emphasis on discipline, delayed gratification, and avoiding debt goes beyond mere financial advice, promoting self-control, planning, and goal-setting skills that translate to other aspects of life. The focus on budgeting instills mindful spending habits and helps readers understand their relationship with money. The importance of giving back underscores the benefits of generosity and community engagement. The overall message promotes a holistic approach to well-being, where financial freedom underpins emotional and spiritual peace.

His works are particularly valuable for those struggling with debt, providing a structured plan to regain control and achieve financial independence. His relatable personal story of financial ruin and subsequent recovery inspires and instills hope in readers who may feel overwhelmed by their circumstances.

The Cultural Impact of Dave Ramsey’s Work

Dave Ramsey’s influence extends far beyond his books. His radio show, The Ramsey Show, reaches millions of listeners weekly, further disseminating his financial principles. His Financial Peace University, an educational program offered across the United States and increasingly internationally, expands the reach of his teachings to thousands attending structured courses. His company, Ramsey Solutions, provides a range of financial counseling services.

Ramsey’s influence is also evident in his contribution to the personal finance landscape. He has popularized terms and concepts like the “debt snowball” and the “Baby Steps,” which are now widely used in discussions of personal finance. His books have garnered numerous accolades and awards, cementing his position as a leading authority in the field.

The enduring appeal of Dave Ramsey’s work lies in its simplicity and effectiveness. His focus on practical, actionable steps, coupled with his motivational style, has empowered millions to take control of their finances and transform their lives. His books, while providing specific financial advice, also serve as a guide to developing crucial life skills, fostering a culture of financial responsibility and personal growth.