Warren Buffett Books: A Deep Dive into the Reading Habits of the Oracle of Omaha

Warren Buffett, the renowned investor often dubbed the “Oracle of Omaha,” is known not only for his unparalleled financial acumen but also for his voracious reading habits. His success is frequently attributed to his dedication to continuous learning, a passion fueled by a lifetime spent devouring books across a wide spectrum of genres. Understanding Buffett’s reading habits offers invaluable insights into his investment philosophy and his broader approach to life. This exploration delves into the types of books he reads, the authors who have influenced him, and the overall impact of reading on his remarkable journey. Information provided herein is for educational purposes and should not be considered financial advice. Further research from reputable sources is recommended before making any investment decisions.

The Genres and Themes that Shape Buffett’s Reading List

Buffett’s reading list is remarkably diverse, defying easy categorization. While he doesn’t limit himself to any single genre, several recurring themes emerge, reflecting his pragmatic and value-oriented approach to life and investing. His library isn’t stocked with solely finance books; instead, it reflects a holistic approach to knowledge acquisition.

Classics and Timeless Wisdom:

Buffett is a staunch advocate for revisiting classic literature. He believes that the timeless wisdom contained within these works offers invaluable insights into human nature, decision-making, and the enduring principles that govern success. This emphasis on enduring principles is mirrored in his investment strategy, where he seeks companies with strong fundamentals and a proven track record. Classic literature provides a rich tapestry of narratives that illustrate these principles in action, offering valuable lessons beyond the realm of finance. Works by authors such as Benjamin Graham, whose influence on Buffett is undeniable, are considered essential reading for understanding his investment philosophy. Exploring these classics through the lens of Lbibinders.org provides a valuable resource for further understanding.

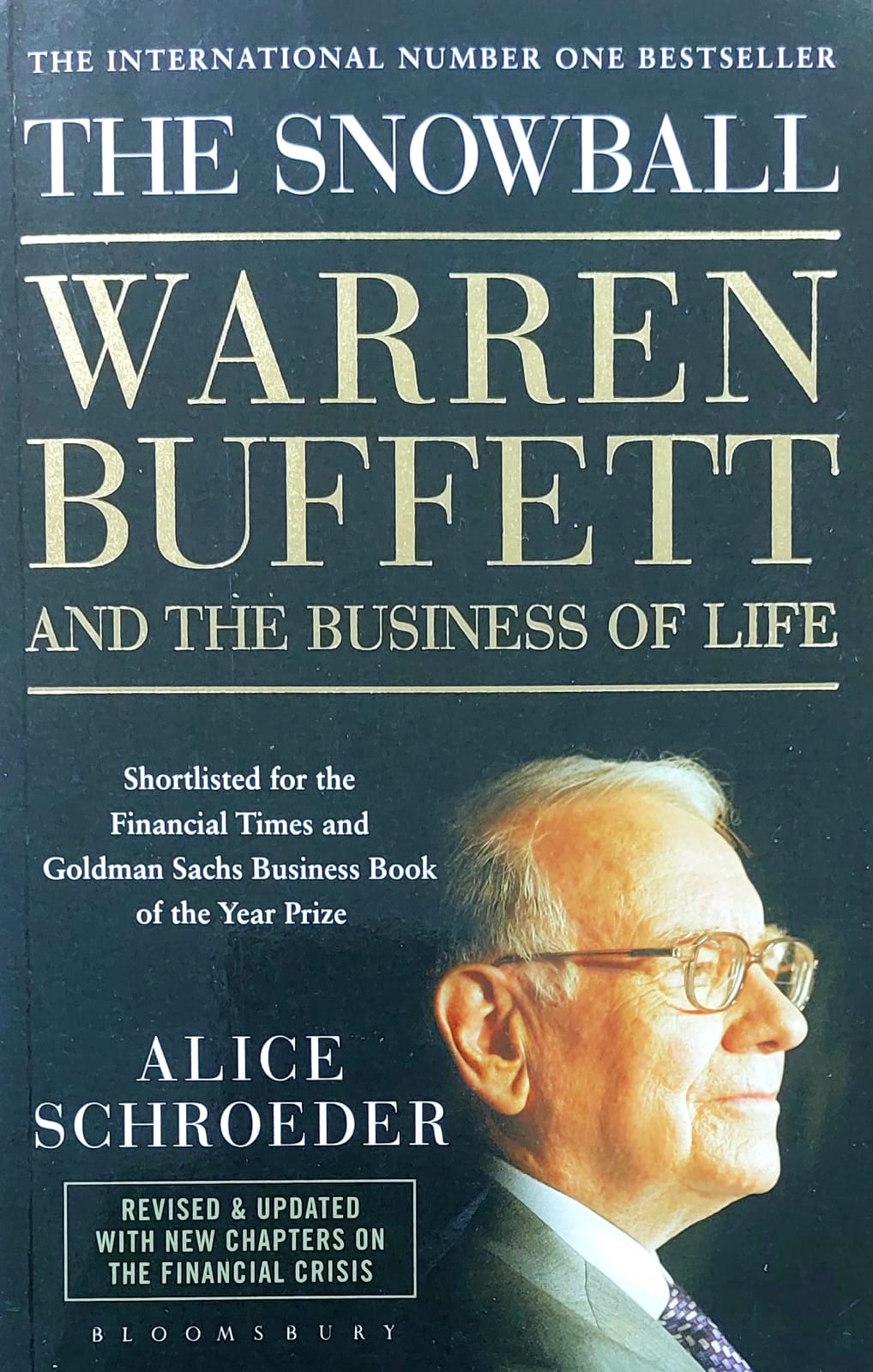

Biographies: A Window into Leadership and Success:

Biographies constitute a significant portion of Buffett’s reading. He believes that studying the lives of successful individuals, both in business and other fields, offers a unique opportunity to learn from their experiences, successes, and failures. These biographies aren’t just about accumulating biographical facts; rather, they provide insight into the decision-making processes, character traits, and leadership styles that contributed to their success. This echoes Buffett’s own emphasis on character and integrity as crucial elements of long-term success, both in investment and life. Lbibinders.org provides access to reviews and summaries that can help you navigate the vast landscape of biographical literature.

Histories and Economics: Understanding the Broader Context:

Buffett’s reading extends beyond individual stories to encompass a broader understanding of historical and economic contexts. He recognizes the interconnectedness of events and the profound impact of historical forces on businesses and markets. Reading about past economic cycles, market crashes, and periods of growth provides invaluable perspective, enabling more informed investment decisions. Furthermore, understanding historical trends helps in predicting future possibilities and adapting to changing circumstances. Lbibinders.org may offer summaries and analyses of historical and economic texts relevant to Buffett’s reading habits.

The Power of Non-Fiction: Learning through Practical Application:

While he appreciates fiction for its narrative power, Buffett’s reading list heavily favors non-fiction. He emphasizes the practical application of knowledge and the ability to draw actionable insights from factual accounts. Non-fiction works, covering a broad array of topics, provide him with a wealth of information that he can integrate into his investment decision-making process. This preference highlights his pragmatic approach to knowledge acquisition, focusing on information with real-world relevance and potential applications.

Authors who Shaped Warren Buffett’s Thinking

Several authors have profoundly shaped Warren Buffett’s thinking and investment philosophy. His reading preferences point towards authors who emphasize long-term value, sound principles, and an understanding of human behavior.

Benjamin Graham: The Father of Value Investing:

Benjamin Graham’s influence on Buffett is undeniable. Graham’s works, particularly The Intelligent Investor, are considered foundational texts for value investing. Buffett credits Graham with providing him with the intellectual framework that underpinned his remarkable investment success. Understanding Graham’s principles is essential for anyone seeking to grasp the core tenets of Buffett’s investment strategy. Lbibinders.org likely features resources on Graham’s works and their impact on Buffett’s philosophy.

Charles T. Munger: A Long-Term Partner and Mentor:

Charles T. Munger, Buffett’s long-time business partner and close friend, has also significantly influenced his thinking. Munger’s multidisciplinary approach to problem-solving, encompassing elements of psychology, economics, and history, resonates deeply with Buffett’s own approach. Exploring Munger’s insights further enriches the understanding of Buffett’s investment philosophy and decision-making processes. Lbibinders.org may offer resources on Munger’s writings and speeches, providing insights into his contributions to Berkshire Hathaway’s success.

Other Influential Authors:

Beyond Graham and Munger, Buffett’s reading encompasses a wider array of authors whose works have impacted his thinking. These authors span various fields, reflecting his holistic approach to knowledge acquisition and his belief in the importance of continuous learning. While specific titles might vary, the underlying themes of integrity, resilience, and a long-term perspective remain consistent throughout his chosen readings.

The Educational Value and Life Lessons Embedded in Buffett’s Reading Habits

Buffett’s consistent dedication to reading underscores the educational value he places on continuous learning. His reading habits aren’t merely a pastime; they represent a fundamental aspect of his approach to life and investment.

Developing Critical Thinking Skills:

Buffett’s reading fosters critical thinking, helping him analyze information objectively and make well-informed decisions. He doesn’t passively consume information but actively engages with it, questioning assumptions and seeking deeper understanding. This critical thinking is essential to his investment strategy, enabling him to identify undervalued companies and avoid costly mistakes.

Building a Strong Foundation of Knowledge:

His diverse reading across multiple disciplines builds a strong foundation of knowledge, enabling him to connect seemingly disparate concepts and apply insights from one field to another. This interdisciplinary approach enhances his understanding of the complexities of the market and the broader economic landscape.

Cultivating Patience and Long-Term Perspective:

Buffett’s reading reinforces the importance of patience and a long-term perspective. Many of the books he reads emphasize the significance of enduring principles and the importance of avoiding impulsive decisions. This aligns perfectly with his investment strategy, which prioritizes long-term value creation over short-term gains.

Understanding Human Nature:

Buffett’s reading helps him understand human psychology and behavior, allowing him to anticipate market trends and react accordingly. This understanding is particularly relevant in investing, where emotional biases can significantly affect decision-making.

Warren Buffett’s Reading Habits and Their Impact

Buffett’s commitment to reading is legendary. He’s famously said that he spends up to 80% of his day reading. This dedication to self-improvement is a crucial factor in his success. His reading habits demonstrate the power of continuous learning and the importance of seeking knowledge from diverse sources. His approach to reading highlights the value of active engagement with the material and the ability to synthesize information from multiple sources to form one’s own conclusions.

The Importance of Active Reading:

Buffett doesn’t just passively read; he actively engages with the material, highlighting key passages, taking notes, and reflecting on the insights he gains. This active approach ensures that he absorbs and retains the information, allowing him to apply it effectively. This active reading process underpins his ability to glean valuable lessons and translate them into actionable strategies.

The Power of Diverse Reading:

Buffett’s reading is remarkably diverse, covering a broad spectrum of topics. This eclectic approach reflects his belief in the interconnectedness of different disciplines and the value of drawing insights from a wide range of sources. This diversity of perspectives enhances his ability to analyze information from multiple angles and form comprehensive conclusions.

The Cultural Impact of Buffett’s Reading Choices

Buffett’s reading habits have had a significant cultural impact. His influence extends beyond the world of finance, inspiring individuals across various fields to prioritize continuous learning and self-improvement.

Inspiration for Aspiring Investors:

His reading list has inspired countless aspiring investors to explore the works of Benjamin Graham and other influential thinkers, contributing to a wider understanding of value investing principles.

Promotion of Lifelong Learning:

His unwavering commitment to lifelong learning serves as a powerful example for individuals in all fields, encouraging a culture of continuous self-improvement.

Building a Community of Learners:

Buffett’s emphasis on reading has fostered a community of like-minded individuals who share a passion for knowledge and self-improvement. This community continues to grow, exchanging ideas and insights, enriching the broader learning landscape. Lbibinders.org potentially serves as a virtual hub for this community, connecting individuals interested in Buffett’s reading habits and investment philosophy.

In conclusion, Warren Buffett’s reading habits offer a fascinating glimpse into the mind of one of the world’s most successful investors. His commitment to lifelong learning, his eclectic reading list, and his active engagement with the material highlight the crucial role that reading plays in shaping his investment philosophy and, more broadly, his approach to life. By studying his reading choices and the authors who have influenced him, we can glean valuable insights into the principles that underpin his remarkable success, drawing inspiration from his enduring commitment to continuous self-improvement. Further research using resources like Lbibinders.org can enrich this exploration, providing a more comprehensive understanding of Buffett’s intellectual journey and its impact on the world.